how to calculate tax on uber income

Youll probably need to earn a profit of at least 5000. Public on the web.

Uber Tax Forms What You Need To File Shared Economy Tax

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr From Lyft Express Drive To Fair How To Get The 500 Fair Switch Bonus Lyft Driver Rideshare Lyft Pin On Money Saving.

. See What Credits and Deductions Apply to You. You only pay tax on the profit you have left after you subtract all your expenses from your business income. Youll report income through the standard tax return Form 1040.

Plus there may be additional state and. Social Security tax rate. Youll use Schedule C to list your income and expenses and expenses write-offs.

Anyone on the Internet can find and access. Even if you earn. 62 for the employee.

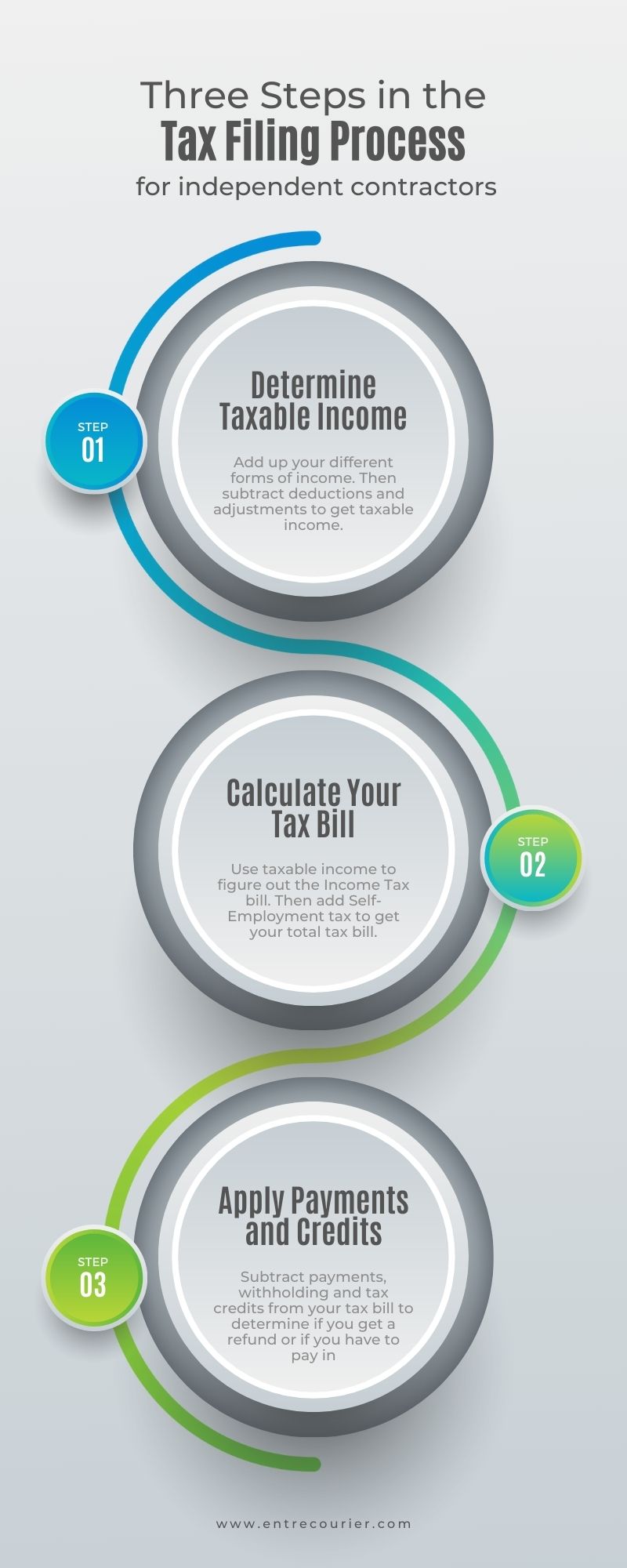

One notable exception is if the 15th falls on a. In subtracting your business expenses from your income you put the differences known as business income or loss on line 3 of Schedule 1 for Form 1040. Federal payroll tax rates for 2022 are.

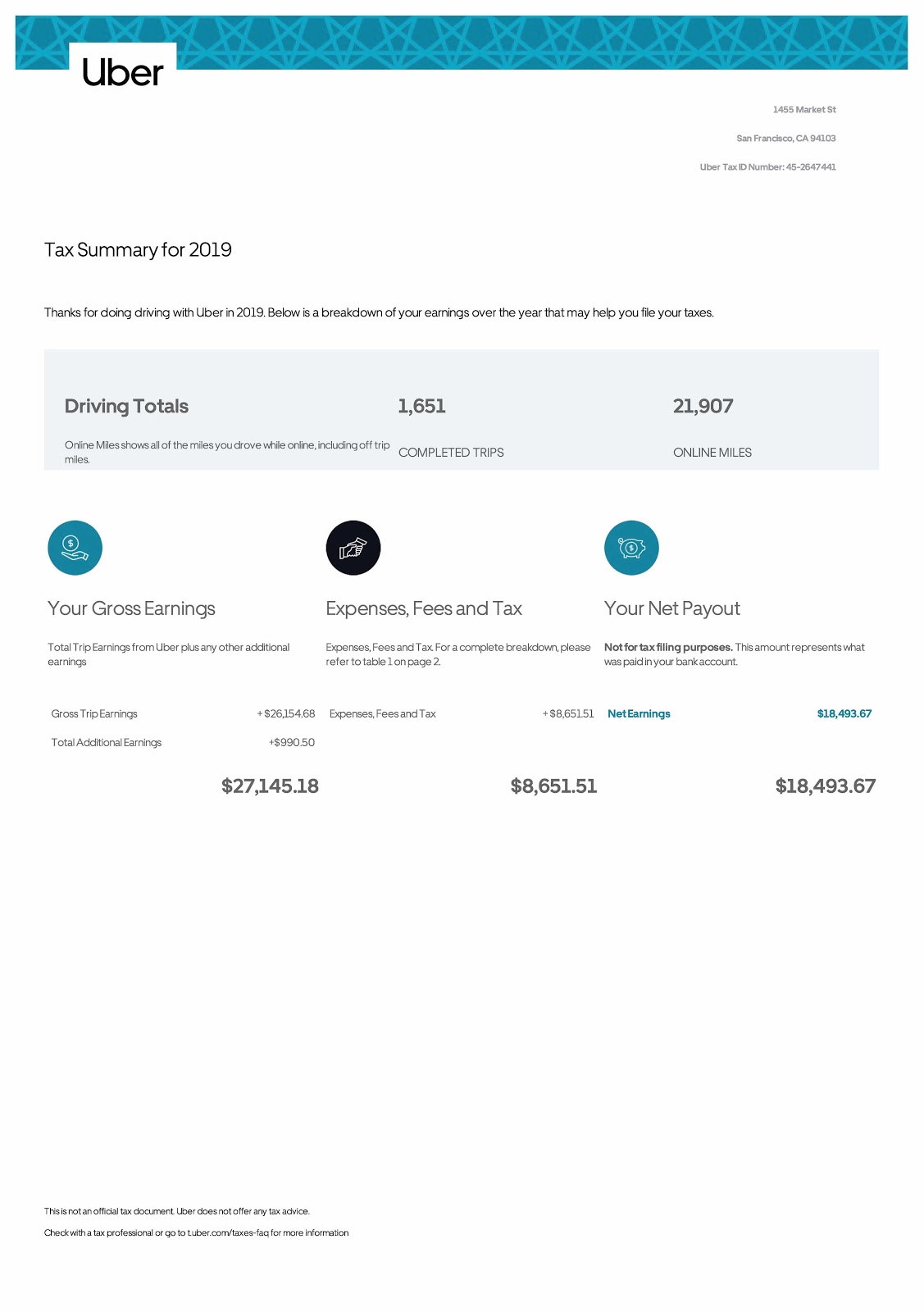

You can find tax information on your Uber profile well provide you with a monthly and annual Tax Summary. With so many people looking to hail a ride the Big Apples Uber drivers have the potential to make up to 3035 an hour. If your annual income is over 18000 and less 37000 then the tax rate is 19 and you can get 675 1-19 54675.

Youll report income through the standard tax return Form 1040. This calculator will help you work out what money youll owe HMRC in taxes from driving for Uber. Any money you make driving for Uber counts as income meaning you must declare it on your Tax return.

How to calculate income from yearly uber statement for personal income tax 1. Ad Enter Your Tax Information. Doing the math for a 40-hour work week thats 1214.

Estimate the areas of your tax return where needed. Im not a tax expert or a professional CPA. You must pay estimated taxes if you expect to owe at least 1000 in federal tax for the year from your ride-sharing business.

On this form you list all your business income and deductible expenses. Every rideshare driver must calculate their rideshare income subtract their tax. From the dropdown menu select Partner Earnings.

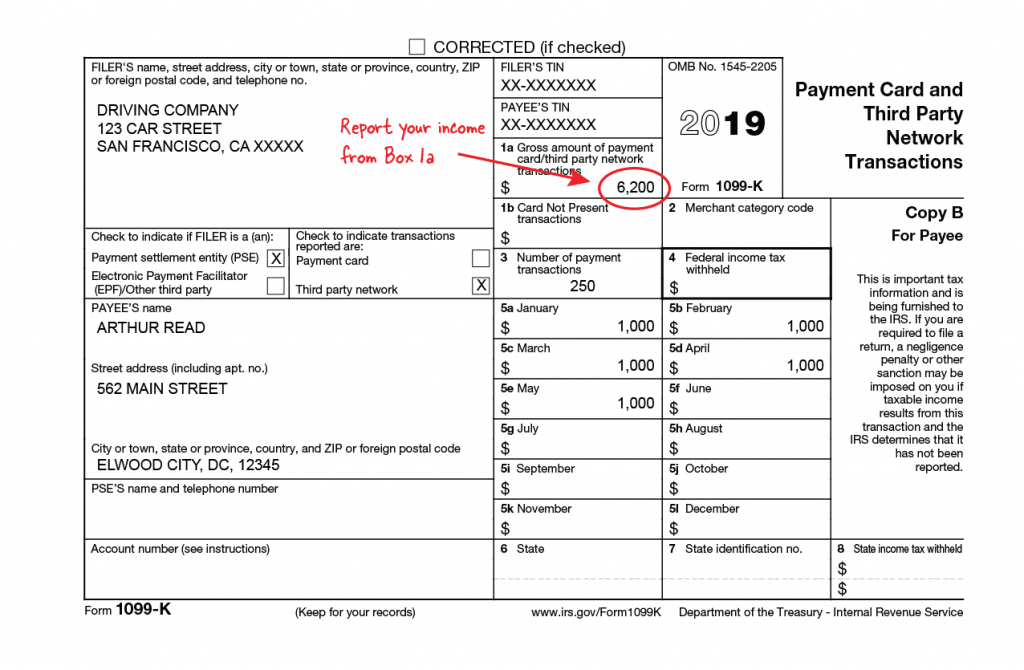

However a flat rate of 5 applies to taxable income over. There are two taxes that youll likely be charged. Calculate your gross income from rideshare driving You may receive two 1099 forms from Uber or Lyft but not always.

Income Tax National Insurance Income Tax is. Youll use Schedule C to list your income and expenses and expenses write-offs. You should receive a 1099-K if you.

Find recommended local service professionals get free quotes fast with Bark. Discover Helpful Information And Resources On Taxes From AARP. As you make progress the taxes.

You start out by adding up your. The ato uses a marginal tax rate system to calculate this. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

The ATOs Uber tax implications are straight-forward at a basic level. This is just a simple calculator to see an estimate of your taxes with standard deductions. Income tax is not deducted from Uber earnings made throughout the year so drivers must keep records of the money they receive from Uber and all of their expenses to.

Medicare and Social Security. Log in to your Uber account Once logged in navigate to the dashboard menu by clicking your nameicon in the top right. Uber ola taxify gst and tax calculatorthe aim of.

If your annual income is over 37000 then the tax rate. Your annual Tax Summary should be available around mid-July. Use business income to figure out your self-employment tax Add other income you received wages investments etc to figure out total income Subtract deductions and.

Estimated taxes are paid quarterly usually on the 15th day of April June September and January of the following year. 2 days agoThe rates have gone up over time though the rate has been largely unchanged since 1992. Starting in 2022 there is no state income tax on the first 5000 of taxable income in Mississippi.

Yes Uber income is taxable just like all income earned by employees contractors and business in Australia.

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Canadian Rideshare Taxes Income Tax For Uber And Lyft Drivers

Uber Drivers Gross Income Vs Net Income Turbotax Tax Tip Video Youtube

Rideshare Deductions Standard Mileage Vs Actual Vehicle Expenses Rideshare Deduction Uber

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

When You Get To The End Of March There Are A Bunch Of Tax Forms That You Should Have From People D Personal Finance Budget Personal Finance Money Saving Tips

How To Report Income From Uber In A Canadian Tax Return Youtube

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr Uber Tax Uber Driver

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Uber Tax Summary 2021 Compilation Spreadsheet For Uber Drivers Youtube

Uber Drivers Often Unaware Of Tax Obligations Cbc News

Freelancer S Guide To Quarterly Estimated Taxes Freelancers Guide Business Advice Freelance Writing

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Turbotax Canada Uber Partner Webinar For The 2017 Tax Year Youtube

Irs Uber Mileage Log Tax Deduction With Triplog Tracking App Tax Deductions Tracking App Templates

The Uber Lyft Driver S Guide To Taxes Bench Accounting

This Is How Much You Need To Drive For Uber Or Lyft To Make 50 000 A Year Uber Driving Uber Driver Rideshare

Uber Drivers Gross Income Vs Net Income Turbotax Tax Tip Video Youtube